The Latest Investment Fad Is Unsustainable

The latest investment fad is ESG (Environmental, Social, Governance), a type of “socially conscious” investor screen and investment fund category that grew out of SRI (socially responsible investing). Although presumably as novel as the coronavirus that causes COVID-19, long dead people like Armen Alchian, Milton Friedman, Julian Simon, and the Founding Fathers would have seen right through it.

In short, ESG is unsustainable. Focus on G, or governance, will work to the extent that it reduces the expropriation of shareholder wealth, but E and S dilute shareholder wealth and hence destroy themselves to the extent they succeed.

In any competitive market worthy of the name, maximizing profits is difficult enough without worrying about multiple goals and masters. To the extent that managers are accountable to multiple constituencies, they become accountable to no one. (See on this point William J. Carney, “From Stakeholders to Stockholders: A View from Organizational Theory,” in Peter J. Hill and Roger E. Meiners, eds. Who Owns the Environment? New York: Rowman & Littlefield, 1998, p. 199.)

Focus on “environmental” goals risks shareholder wealth to the extent that it privileges irrational “green” objectives, like most forms of renewable energy. Julian Simon (and Matt Ridley and others among the living) rightly questioned the environmental degradation narrative that many people simply assume is true after decades of false or misleading stories about acid rain, holes in the ozone layer, and superstorms. In fact, wealthy countries’ environments have greatly improved in recent decades. In North America, many forms of wildlife have returned to, and even exceeded, their Pre-Columbian population levels.

Even former manufacturing sites of mustard gas and other nasty chemicals have been successfully returned to a wild state. One, the 15,000-acre Rocky Mountain Arsenal Wildlife Refuge just outside Denver, supports an extensive ecosystem including bald eagles, bison, coyotes, deer, and ferrets. Many types of wildlife returned spontaneously, or thrived after deliberate reintroduction, just as they did in the area around Chernobyl. (It seems humans are more toxic than the bad stuff they make.)

Environmental entrepreneurism (enviropreneurism), not inefficient “feel good” virtue signaling investments, promise yet greater improvements. Instead of pitting opposing interests against each other to duke it out in the political realm, enviropreneurs seek creative ways to achieve conservation goals by leveraging incentives, not damning markets. In inland and inshore oceanic fisheries, for example, assigning property rights to fishers has led to a rebound of many fish stocks because fishers now have incentives to maintain sustainable harvest levels. In the American West, the reintroduction of wolves has helped to keep the population of prey animals, like elk and mule deer, in check without human interventions (hunting, poisoning, winter feeding). Ranchers acceded because they receive compensation from enviropreneurs when wolves kill their livestock.

The Property and Environment Research Center (PERC) and other NGOs are working on many other such projects, which stand in stark contrast to the many dubious projects outlined in Planet of the Humans and other sources critical of how “Green” (environmentalism) has become “green” (all about the subsidies).

If you are looking for a good free-market beach book, check out the 2012 critique of local food sourcing by Pierre Desrochers and Hiroko Shimizu, The Locavore’s Dilemma: In Praise of the 10,000-Mile Diet (New York: Public Affairs). According to Missouri farmer Blake Hurst, the authors “take the idea of local food to the back of the barn and beat the holy livin’ tar out of it” (p. xiii). For more heady stuff, a clarion call “for environmental markets based on well-defined, enforced, and transferable property rights” (p. 204), try Terry L. Anderson and Gary D. Libecap, Environmental Markets: A Property Rights Approach (New York: Cambridge University Press, 2014).

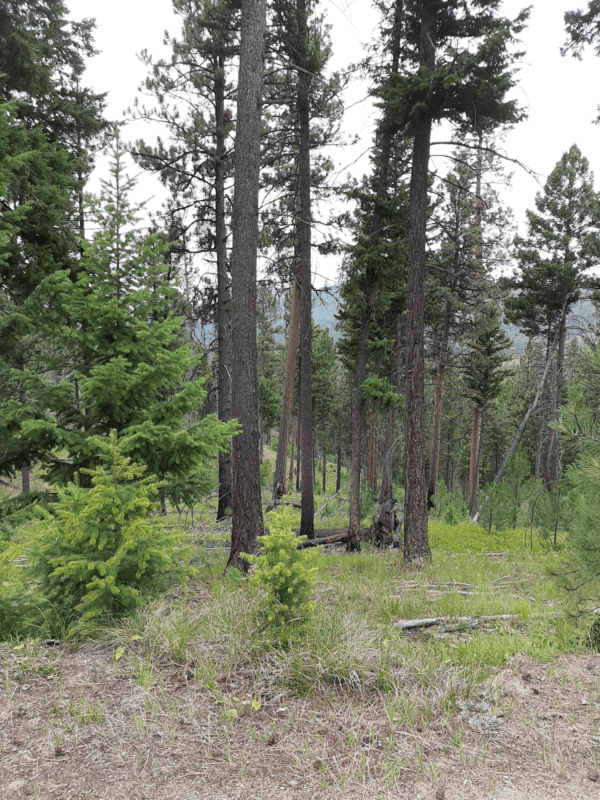

Even, or perhaps especially, when it comes to the environment what matters most are incentives, not ideology. When fires ravaged Montana’s Bitterroot Mountains in 2000, for example, the Sula State Forest rebounded much more quickly than the adjacent and biologically identical Bitterroot National Forest. State forest officials were charged with maximizing profits from the land for the benefit of Montana’s school system so they quickly took steps to log and sell fire-damaged trees and replant. Timber sales brought in $4.5 million for the school fund and another $785,000 in revenue for future forest improvements. By 2010, the burned areas were healthy and thriving. The contrast today (22 July 2020) remains striking, as pictures from my recent trip to the area reveal:

On the federally-owned side of the line, “analysis paralysis” set in, as did invasive weeds like leafy spurge. Environmentalists delayed reclamation efforts for years fighting to “save” 199 burned trees (in a 1.5 million acre forest!) solely because they were more than 22 inches in diameter. Why? The lives of 22+ inch diameter trees matter, even when those trees are already dead? The environmentalists won in court but everyone else, including sundry forest critters, lost. Little wonder that a favorite bumper sticker in some parts reads: “Are you an environmentalist or do you work for a living?” (For details, see Linda E. Platts, Forest Fires New York: Thomson Gale, 2005, pp. 50-62).

I bet a bumper sticker reading “Do you advocate corporate social responsibility or do you have a brain?” would do equally well in many a neck of the investing woods. CSR, or just S in the ESG framework, is as irrational as knee-jerk environmentalism. Just as Greens can destroy the environment, CSR can wreck society while tricking ESG investors to feel good about themselves in the process. Not that that stopped POTUS Democrat candidate Joe Biden from endorsing it.

Armen Alchian showed that selective pressures will eliminate firms that do not maximize profits, regardless of why. The more sophisticated proponents of ESG note that Alchian’s proof only applies to firms in competitive markets and argue that most firms earn quasi-rents, and it is those “extra” profits that ESG investors seek to redistribute. As any student of entrepreneurship knows, those quasi-rents, which arise from first-mover advantages, branding, patents, trade secrets, and so forth, are what induce innovation in the first place. In addition, the existence and magnitude of quasi-rents is difficult to ascertain because even when only one firm dominates an industry it may, if its monopoly is contestable, price nearly the same as a firm in a perfectly competitive market would. The same goes for automobile manufacturers and other firms engaged in monopolistic competition. While the degree of rent-seeking activity remains lamentable, Gordon Tullock believed that in non-autocracies “for the most part, companies do not make the kind of excess profits that they would make if they had a private monopoly” (Charles K. Rowley, ed., The Selected Works of Gordon Tullock: Volume 5, The Rent Seeking Society [Liberty Fund 2005], 5:30). In other words, activist ESG investors could easily overestimate quasi-rents, thereby increasing the probability that the firms they invest in will fail. Besides, society is better off dissipating quasi-rents by increasing competition rather than forcing executives to donate them to sundry causes of dubious social benefit.

Milton Friedman, after all, showed that profit maximization is socially responsible because it discovers and makes imperative the most efficient known use of all resources. In green terms, profit maximization minimizes waste. The best known example is the bison. Remember the old adage that American Indians used every part of the bison? That was true in the sense that at some time or another members of the Lakota and other Plains tribes turned each part of the giant beasts into something useful. It was not true, however, that they used every part of every bison harvested. Often, they simply took the choicest meats, like the tongue, or an unborn fetus, the equivalent of veal. Do you know who actually uses every part of every bison? The modern bison ranchers and slaughterhouses that manage to stay in business.

Moreover, America’s Founders confronted claims for CSR by developing a new type of corporation now called the nonprofit. If you want to help others by maximizing profits and minimizing waste, they said, form a for-profit or “moneyed” corporation. If you want to help others directly without an intervening market mechanism, then form an eleemosynary or other “nonpecuniary” corporation. The Founders’ solution remains the only viable one for any society interested in maximizing innovation, the key to the productivity increases that make things like cheap food, smart phones, and novel coronavirus vaccines possible.

G, by contrast, attempts to minimize the expropriation of shareholders by executives or large blockholders. It is at a low ebb currently and needs to be revivified by returning to a republican form of governance replete with checks and balances, hoary ones as well as a renewed market for corporate control.

For America’s first century or so, corporations (for- and non-profit) were akin to mini-republics replete with constitutions (charters), unicameral legislatures incentivized to maximize profits (board members who had a sizeable chunk of their net worth at stake in the corporation), and sundry checks against misappropriation of resources (legal concepts like ultra vires, prudent mean voting rules, shareholder inspections and audits, etc.).

As the initial system degraded after the Civil War, investment banks stepped in to protect investors from corporate executive and blockholder malfeasance in order to protect their valuable business reputations. J.P. Morgan was the most famous investment banker of that type but many others also provided monitoring on behalf of investors. Unfortunately, New Deal legislation ended that system, forcing investors to rely on the Securities and Exchange Commission (SEC) for protection against executives with sticky fingers.

The SEC could not well protect the interests of all investors in all corporations large and small, leading in the postwar period to the rise of corporate activists, dismissively called “gadflies,” like Wilma Soss and the Gilbert brothers. By the 1970s, the gadflies had managed to restore some power to stockholders through proxy resolutions, secret ballots, cumulative voting, and other reforms but corporate executives were still able to increase their salaries and perks much more quickly than the wages of their workers or the dividends of their stockholders.

By the 1980s, however, so many corporations had become bloated conglomerates that their parts were actually worth more than the whole. Corporate raiders made big bucks buying and breaking them up into more efficient pieces. Leveraged-buyout firms like Kohlberg, Kravis, Roberts (KKR) issued high yield bonds to fund some of the takeovers and to better incentivize managers. Productivity soared until executives adopted governance techniques, like poison pills, that effectively killed the market for corporate control that had developed.

Ever since, shareholders and management have fought pitched battles over policies like “Say on Pay” but managers generally maintain the upper hand. Shareholder activism has become the realm of large institutional investors instead of brave individuals like Soss. Many investment funds still follow the old “Wall Street rule” — if they spot trouble at a company, they quietly sell it and let the sucker buyer eat the loss. Others will short it (try to profit from a price decrease). But some, like TIAA-CREF, will use their votes to try to induce reforms. That’s clearly not for everyone but it is sustainable to the extent that corporations can increase demand for their shares by improving governance.